It's attainable that only one quarter of 1 per cent can finish up preserving tens of hundreds around the duration of your loan. Also, beware any fees added to the property finance loan. This will vary greatly according to the mortgage loan supplier.

Interest is the set you back fork out to borrow income or even the payment you get for lending funds. You could possibly pay out interest on an car loan or credit card, or acquire fascination on income deposits in interest-bearing accounts, like price savings accounts or certificates of deposit (CDs).

On the other hand, some assets use very simple fascination for simplicity — for instance bonds that pay back an curiosity coupon. Investments may also present a simple fascination return as being a dividend. To make use of compounding you would want to reinvest the dividends as included principal.

Getting a home finance loan for a home is really pretty easy. I like to recommend these actions. 1. Talk to your neighborhood bank. 2. Test a home loan company to perspective prices and obtain an on-line quote. A mortgage loan banker ordinarily wants numerous yrs of tax returns in addition to a assertion within your assets and debts.

For this identical explanation, uncomplicated desire does not function within your favor being a lender or investor. Purchasing assets that don't offer compound growth indicates you could possibly overlook out on likely progress.

In excess of the long run, compound curiosity can set you back extra to be a borrower (or gain you additional as an investor). Most bank cards and loans use compound fascination. Personal savings accounts also supply compounding interest schedules. You can Look at with the financial institution around the compounding frequency within your accounts.

Underneath this formulation, you are able to work out basic interest taken about distinct frequencies, like daily or every month. As an illustration, in the event you needed to determine every month curiosity taken over a month-to-month foundation, then you would input the every month interest fee as "r" and multiply by the "n" variety of durations.

Easy curiosity is fascination that is only calculated about the First sum (the "principal") borrowed or deposited. Generally, straightforward fascination is about as a hard and fast share for the duration of a loan.

The Simple Curiosity Calculator calculates the curiosity and conclusion harmony dependant on the simple interest formula. Click the tabs to determine the various parameters of the simple interest formulation.

One of many shocking factors I figured out is how a little change in fees can have an affect on your full amount of money compensated. Test using the calculator to check different desire premiums.

Irrespective of how generally uncomplicated curiosity is calculated, it only applies to this primary principal total. Quite simply, foreseeable future interest payments will not be impacted by Beforehand accrued fascination.

Compound curiosity calculations can get elaborate speedily because it involves recalculating the starting up balance just about every compounding period.

Very simple curiosity is effective with your favor as a borrower, since you're only shelling out curiosity on the initial equilibrium. That contrasts with compound curiosity, in which you also pay curiosity on any gathered interest. You may see uncomplicated desire on quick-expression loans.

Compound interest is another way of examining desire. In contrast to basic desire, compound desire accrues interest on the two an First sum together with any desire that accumulates and provides on to the loan.

It's feasible that just one quarter of one % can wind up conserving tens of 1000's in excess of the size on the loan. Also, beware any expenses extra to your property finance loan. This will vary greatly based on the mortgage loan provider.

Alternatively, You can utilize the simple interest components I=Prn When you've got the fascination charge each month.

They are going to also want particulars of your home order. Commonly, you'll get an appraisal, a house inspection, and title insurance plan. Your real-estate agent or bank can prepare this to suit your needs.

Taking check here a look at this loan desk, it's easy to check out how refinancing or paying out off your home loan early can definitely impact the payments within your 3.6k loan. Insert in taxes, insurance policy, and routine maintenance fees to secure a clearer picture of Over-all house ownership prices.

One of many astonishing things I uncovered is how a little distinction in costs can affect your whole total compensated. Attempt using the calculator to check unique desire prices.

They're going to also want aspects of your home obtain. Generally, you'll get an appraisal, a house inspection, and title coverage. Your housing agent or lender can set up this for you.

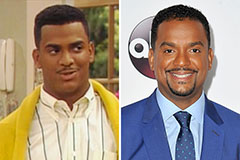

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!